Fighting fraud starts with a plan

With frauds and scams still plaguing consumers and businesses, SVP/Treasury Management Joe Lenzie offers this advice: Stop at the first sign of fraud, have a plan to protect your data—and stay informed. He also describes tactics developed to fight them, as well as the ways that both fraudsters and businesses are turning AI to their advantage.

- US Economy Marches On—Government shutdown and tariff shock couldn’t stop the US economy from above-trend growth.

- Great Year for Bonds and Stocks—Quiet yet volatile finish capped off a year that produced upper single-digit bond returns and a third consecutive year of double-digit returns for the S&P 500.

- Uncertainty at Federal Reserve—With Chairman Jerome Powell’s term ending in the next several months and economic data mixed, the Federal Reserve appears unusually split on the direction of monetary policy.

Monthly Interest Rate Update

Kevin Warsh has been nominated as the next Federal Reserve Chair. Despite his hawkish background, he now supports rate cuts tied to AI-driven productivity gains, even as job growth slows and the labor market remains fragile.

Markets have reacted calmly. Interest rates and Treasury yields have changed little; the yield curve continues to steepen and expectations for gradual rate cuts remain largely intact despite broader political and market volatility.

The smart homeowner’s guide: 4 benefits of refinancing your home loan

Refinancing a home loan can lower interest rates, reduce monthly payments, shorten the loan term and provide greater stability by switching to a fixed-rate mortgage. To make the right decision, it’s important to evaluate your goals with trusted professionals.

Diversifying your portfolio in a time of global uncertainty

Global financial markets are dynamic, and the future path is often unpredictable. To manage portfolios through these environments successfully, a complete approach to diversification is essential to your investment strategy.

How to get out of debt: fresh strategies for long-term financial freedom

This article explores strategies to help you regain financial stability and achieve long-term freedom from debt. With practical tips and expert guidance, this article can help you choose the best path for your financial goals.

Three reasons why you should be maxing out your HSA

Maxing out your contributions to your HSA each month can be a smart strategy for investing in your long-term financial future.

Why Having a Dedicated Health Savings Account Provider Matters

Partnering with a dedicated HSA provider is an excellent way to increase employee enrollment and engagement in your organization’s HSA plan.

Sorry, no articles were found with your selection.

Kevin Warsh has been nominated as the next Federal Reserve Chair. Despite his hawkish background, he now supports rate cuts tied to AI-driven productivity gains, even as job growth slows and the labor market remains fragile.

Markets have reacted calmly. Interest rates and Treasury yields have changed little; the yield curve continues to steepen and expectations for gradual rate cuts remain largely intact despite broader political and market volatility.

The U.S. dollar fell sharply in late January, reaching multi-year lows against the euro and weakening versus all major currencies as the administration signaled support for a softer USD to boost U.S. production, particularly relative to China. Rates held steady at 3.5%, though a new Fed chair in May could shift expectations toward more aggressive cuts later in 2026. Despite solid GDP, consumer sentiment remains near historic lows amid weak manufacturing and labor data and elevated core inflation. Further USD weakness is expected through 2026, with increased volatility.

- A HELOC is a revolving credit line secured by your home, offering flexible borrowing similar to a credit card but with lower rates.

- You borrow during the draw period (typically 5–10 years) and repay during the repayment period (typically 10–20 years).

- Your borrowing limit is based on your available home equity and loan-to-value (LTV) ratio, usually capped at 80–90%.

- HELOCs can fund home improvements, emergency repairs, education, debt consolidation or other major expenses.

- Costs may include variable interest, closing fees, annual charges and early closure penalties.

- You apply by submitting financial documents, completing a home appraisal and reviewing terms with a lender.

While there’s no one “perfect” way to pay off credit card debt, common strategies like the snowball method, the avalanche method, debt consolidation and performing a balance transfer can help you stay on top of and, ultimately, eliminate credit card debt.

- Start by stabilizing your finances

- Pick a debt repayment strategy that suits you

- Use budgeting to find extra cash

- Leverage tools like balance transfers and consolidation loans

- Explore professional help if needed

A clear, proactive succession plan helps nonprofits navigate leadership changes with confidence. Learn how to prepare, communicate and transition smoothly to protect your mission.

- Safe Harbor = testing certainty: You commit to a required employer contribution (3% nonelective or a safe-harbor match) and the plan is deemed to pass ADP/ACP; often avoids top-heavy if only SH contributions are made.

- Vesting is the big fork in the road: Non-QACA safe harbor employer money is immediately 100% vested; QACA (auto-enroll) is the only safe harbor that allows up to a two-year cliff.

- Traditional = maximum flexibility but testing risk: You can tune eligibility, vesting and employer matching contributions for retention and budget. But, you must pass ADP/ACP annually or fix failures (often via HCE refunds or extra contributions).

- Deadlines can save (or sink) your year: Add 3% nonelective up to 30 days before year-end; miss it and you can still adopt 4% nonelective retroactively after year-end (by the sponsor’s tax-return deadline with extensions).

- 2025 numbers to anchor decisions: Employee deferral $23,500; catch-up (50+) $7,500; special catch-up (ages 60–63) $11,250 (if permitted). Other annual plan limits still apply.

ERP systems drive efficiency, but true ROI comes from ongoing optimization. Discover how to build the right team, manage change and apply best practices to turn your ERP into a strategic advantage.

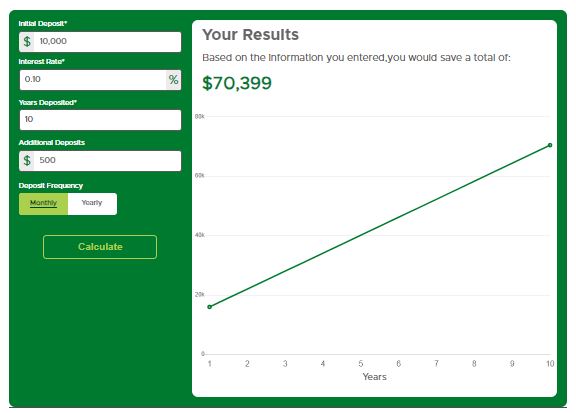

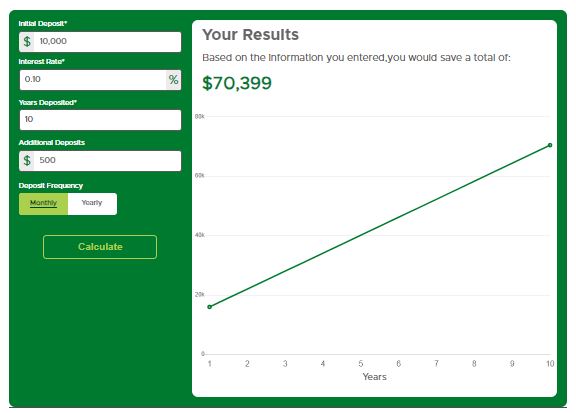

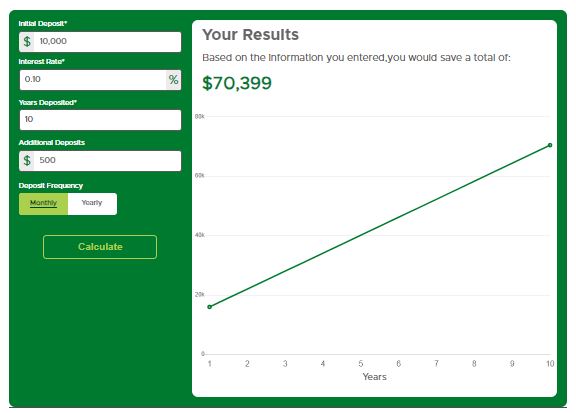

Are you saving enough? Or could your money be working harder for you? This savings calculator gives you the answer in seconds, showing how small deposits today can snowball into serious wealth tomorrow. With just a few numbers, you can see the power of compound interest, test different saving strategies and plan for your financial goals with confidence.

- 50% of family businesses still don’t have a succession plan in 2025—putting their legacy and continuity at risk.

- Succession planning isn’t just for retirement—it protects your business during unexpected events or leadership changes.

- This guide covers team selection and valuations to successor training and communication protocols.

- Don’t make costly mistakes and emotional delays by structuring your plan with clarity, governance and financial foresight.

- Protect your business, your family and your future with a plan that grows with you—not just one built for an exit.

This webinar replay, hosted by Tom Toerpe, Senior Vice President—Capital Markets, offers insights on what the Fed’s next rate moves might look like and their impact on the U.S. economy.

With the One Big Beautiful Bill Act (OBBBA) in effect and 2025 winding down, it's time for a financial plan pulse check. New tax laws, shifting interest rates and market uncertainty make proactive planning key to entering 2026 with confidence.

Scammers are targeting your inbox with increasingly sophisticated Business Email Compromise (BEC) attacks. Stay alert, verify requests and act fast if something feels off.

- Rising interest rates decrease homebuying power: As interest rates rise, monthly mortgage payments increase, reducing the amount of home you can afford. For example, a 1% increase in rates can add hundreds of dollars to your monthly payment for a $420,000 home.

- Understand rate-driven affordability shifts: A 0.62% drop in interest rates can price 2.8 million additional households into the market, while a 1% increase can significantly reduce purchasing power.

- Evaluate mortgage options carefully: Fixed-rate mortgages offer stability, while adjustable-rate mortgages provide short-term savings. With rates projected to hover between 6.7% and 7% in 2025, compare options to find the best fit for your financial situation.

- Plan ahead: Rising home prices (projected to increase by 4% in 2025) and rate volatility make it essential to monitor economic trends and plan for affordability challenges.

- Partner with a trusted bank: Work with a reliable financial institution to access tools like rate locks, affordability calculators, and expert guidance to navigate the changing market and achieve your homeownership goals.

Artificial intelligence (AI) is changing the landscape of cybercrime. AI cyber fraud is a growing threat, and understanding how it works is the first step in protecting yourself and your financial information.

Understanding accounts payable (AP) automation systems can be overwhelming. This expert-led discussion, recorded 8/5/2025, breaks down how these systems can benefit your business as well as key factors to consider when choosing a solution.

A health savings account (HSA) offers tax advantages and long-term growth, but its real value shines in emergencies—providing a ready, tax-free source of funds to cover sudden medical expenses without dipping into your other savings or investments.

Learn how to make the most of your HSA—not just for healthcare expenses today, but for long-term financial growth. With the right approach, your HSA can help you save on taxes, cover medical costs and even build lasting wealth.

More companies are switching to digital methods for their business-to-business payments. If you’re considering this option for your organization, this webinar, held 6/24/2025, can help you better understand current products and trends.

Markets are shifting—so should your strategy. Get expert insights as our panel breaks down the complexities of navigating today’s economic, political and regulatory uncertainty and offers practical guidance for protecting and growing your wealth with confidence.

Ready to start putting your new enterprise resource planning (ERP) system into action? This webinar, the second of a three-part series about ERP systems, covered tips for doing it the right way, things to keep in mind and why a trusted partner is important.

Global financial markets are dynamic, and the future path is often unpredictable. To manage portfolios through these environments successfully, a complete approach to diversification is essential to your investment strategy.

This guide explains how direct deposit works, its key benefits and tips to get started. Take control of your finances and enjoy the ease of direct deposit with help from Associated Bank.

Combining finances is a major decision for couples that can strengthen relationships and improve financial management. However, it’s not without challenges, and couples should consider their unique dynamics before making the decision.

Learn how to manage market volatility by sticking to a disciplined, long-term investment strategy and avoiding emotional reactions. Stay on course for financial success.

This guide offers practical money managing tips for college students. Take control of your finances with simple strategies to track spending, grow savings and make informed financial decisions.

In this article, we will explore the steps to build a good credit score, the benefits of a good credit score and how to maintain a good credit score through good financial habits for ongoing financial success.

Key tools for surprises are rainy day funds and emergency funds. A rainy day fund covers small expenses, while an emergency fund handles major crises. Together, they create a strong financial foundation, offering peace of mind and resilience.

This guide to budgeting for young adults offers practical advice for managing finances, from understanding the basics of budgeting to creating a solid savings plan.

We all have spending habits, some good and some not so good. Bad spending habits often go unnoticed, but they can quietly drain your wallet. In this article, we’ll highlight six common bad spending habits and offer tips to help avoid them.

Selecting and implementing an Enterprise Resource Planning system is a significant undertaking. This session, the first of a three-part series about ERP systems, shared important best practices and common mistakes to avoid.

Successfully saving for a home requires discipline, patience and careful planning. By staying focused and committed, you’ll be on your way to turning your dream of owning a home into reality.

An enterprise resource planning (ERP) system lets you efficiently and accurately access your company’s operational data. This webinar, held 2/19/25, focuses on tips for choosing the best one for your business.

Understand estate planning's importance amid tax changes and reassess strategies to secure your assets and minimize tax burdens.

Associated Bank partners with the Milwaukee Rep to boost local arts, economy and community engagement in southeast Wisconsin.

Protect yourself from scams with tips to secure accounts, spot phishing and stay safe online.

Parents and guardians who want to help their minor children open checking and savings accounts should consider Family Banking, a joint account that gives them freedoms they want and controls you’ll appreciate.

It is no secret that kids pay attention to the grownups. They learn a great deal simply from watching their parents’ behaviors. And this is even true when it comes to financial habits. So as your family grows, your expenses change, and your budget shifts, why not include your young ones on the conversation?

By tracking your expenses, you create a clear record of where your funds are going and can make the necessary adjustments to your spending habits to meet your financial goals.

Early Pay service let checking customers access their direct deposits (such as a paycheck) up to two days earlier than normal.

Merchant services is an umbrella term for the different payment-related software and equipment your business needs to accept credit, debit and online forms of payment.

Accepting electronic payments improves your ability to predict and manage cash flow, allowing for more efficient business processes and more streamlined operations.

Opening a business checking account will make it easier for you to understand your finances, process credit card payments and gain access to loans.

Monitoring your credit score is an important part of ensuring your long-term financial health and gaining access to favorable loan rates.

The fixed-rate option for HELOCs can help homeowners put stability and predictability in their borrowing. Managing fixed-rate balances alongside your variable-rate line can help you control your overall financial strategy.

Maintaining your home equity line of credit (HELOC) includes understanding the right strategies for paying it back. You only need to make monthly interest-only payments during the initial draw period, but paying on the principal as well can help you get the most of your available credit line. Here’s how you can work toward “zero balance.”

This tool shows what your monthly mortgage payment can be and is influenced by many factors, including the price of the home, your down payment, the length of the loan, property taxes, homeowners insurance and the interest rate on the loan. Enter your details below to estimate your monthly mortgage payment.

Learn how to make a mobile check deposit

As you approach retirement, your financial landscape changes. It becomes important to assess your investments, effectively manage your retirement accounts and understand Social Security benefits. This stage of life brings with it key financial decisions, pivotal for ensuring a stable and prosperous retirement.

Estate planning goes beyond wealth preservation. Discover how to pass on core values, ensuring a lasting legacy for future generations.

Choosing the best credit card for your small business often means looking at factors outside of the card’s APR and fees.

Learn the historical impact of U.S. presidential elections on the stock market and how investors and retirees can maintain a stable financial strategy during political transitions.

Maxing out your contributions to your HSA each month can be a smart strategy for investing in your long-term financial future.

Running your business efficiently is likely at the top of your priority list. Here are some tips to streamline your day-to-day business operations, save money, and find new levels of success.

In this article, we explore this nuanced distinction to provide context on why you might want to choose a bank or a brokerage as the custodian for your financial portfolio.

Your HSA can be more than a way to pay for healthcare expenses. Learn how you can use your account to help you meet your financial goals!

Learn the essentials of estate planning to safeguard your assets and impart your values for a thoughtful, enduring family legacy.

Learn how to use Activation Zone on your computer.

Learn how to report your debit card lost or stolen.

If the supply chain crunch of the past few years has any silver lining, it’s the lesson that restricting your vendor options to one or two sources can backfire. If you’re considering broadening your circle of suppliers, you might want to look within your own community—and find partners you’ve never considered before.

The Tax Cuts and Jobs Act of 2017 will be sunset in 2026. Here’s everything you should know about it.

Learn how to consolidate your Health Savings Accounts (HSAs) to maximize earnings, avoid unnecessary fees, and simplify your financial management.

Learn more about how to prevent fraud within your business and the ways companies continue to be at risk.

In December Congress passed the Consolidated Appropriations Act, 2023 which contains a large section covering retirement referred to as SECURE 2.0.

You should consider five key qualities when choosing the best HSA administrator for your business.

Play this short demo to learn how to lock and unlock your debit card in digital banking

We know that taxes are one of life’s two inevitables. So, the question is not if you will pay taxes on your retirement accounts, but when and how much. That’s where Roth IRAs enter the discussion, especially in the current tax and market environment.

The right small business banking partner can accelerate your business’s growth through access to accounts and services tailored to help you manage your funds.

If you want to start a new emergency fund, consider a few basics for how much to save and where to put your money.

Health savings accounts (HSAs) are one of the best ways to save money for healthcare and other expenses in retirement.

Diversification is vital to your investment strategy. Understanding diversification and the advantages of diversifying your investment portfolio are crucial to any investor.

Saving for retirement can often feel like a daunting task filled with complex investing terms and more acronyms than you can count.

However, making sure you have enough money to retire doesn’t have to be overly complex.

A home equity line of credit (HELOC) is a very powerful borrowing tool, offering both financial freedom and flexibility for homeowners who have built equity in their home. Put simply, a HELOC is a flexible, variable-rate line of credit, secured by home equity, that has an almost unlimited number of uses.

The holidays can get expensive, so it’s always wise to start the season with a budget and a plan in mind for managing your spending.

Nobody wants to overdraft their account. However, in the event of an emergency or other unexpected event, you might find yourself in the red. Banks offer a variety of services to help protect you in the event you overdraw your account.

Direct deposit is a helpful financial tool for safely and conveniently transferring money from one account to another. The most common use of direct deposit is for paychecks, as close to 94% of all working Americans use direct deposit to receive their pay every payday.

On average, women are retiring two years earlier and living three to five years longer than their male counterparts. While many elements surrounding longevity are ultimately out of your control, you can take steps to be financially prepared for both the expected and the unexpected. And as a woman, there are some unique considerations you should be aware of when planning for the years to come.

Learn what qualifies as a Charitable Distribution and the Tax Advantages involved if you have not met your IRA requirement minimum distribution.

Learn how to reset your password

A goal-based financial investment strategy sets you on a path for better wealth management. Using goals helps you match your time horizon to your asset allocation, which means you take on the optimum amount of risk. By setting specific goals, you are more likely to achieve them.

Learn how to pay a bill

Learn how to enroll in digital banking

Learn how to set up recurring payments

Learn how to view and edit your Preferences in Associated Bank Digital, including how to mark accounts as favorites and even turn off accounts you don’t want to appear.

Learn how to navigate through Quick Access

Learn how to edit a payee

Learn how to update your personal information

Learn how to update your personal information

Play this short demo to learn how to add a payee in digital banking

“We noticed a shortage of vegan food options when we dined out,” Brandon explained. “That’s what inspired us to start Twisted Plants

At Associated Bank, we recognize the changing face of Milwaukee’s leadership. Younger and more diverse voices have a seat at the table, and we welcome the importance of mentoring this young talent and connecting with different generations to foster collaboration. At Associated Bank, we recognize the changing face of Milwaukee’s leadership. Younger and more diverse voices have a seat at the table, and we welcome the importance of mentoring this young talent and connecting with different generations to foster collaboration.

Growing up, Wilona Young watched her grandmother operate a successful barbeque restaurant in Chicago. “Seeing her success as a small business owner gave me the inspiration and courage I needed to start my own business.”

“Crypto” is many different things to many different people. To some it is the future of money. To others, it is a technology that will decentralize established global systems. And, to many, it is also a way to get rich quickly...

It’s your life. Shouldn’t your dreams, goals, and hopes for the future be at the center of your financial planning goals?

A business without efficiency is a business that’s guaranteed to fail. Optimize your business efficiency and automate your financial processes with Treasury Management services. These services allow you to keep a high level of visibility into your daily balances, manage your funds with a high degree of precision, and even capitalize on your excess cash at competitive rates of return.

Finances are often one of the biggest challenges in starting a small business. That’s why Associated Bank and the Brewers Community Foundation provided a grant to help veteran Patrick Doll get Fleet Clean USA, a mobile truck washing service off the ground. Learn more about Fleet Clean USA.

Promotions can be a powerful way to capture customers’ attention, create excitement and encourage more sales. Here are promotion ideas from Clover®.

To make the homebuying process easier despite these challenging conditions, we’ve put together a few tips to help you each step of the way.

Financial wellness isn’t taught in most schools. With these simple tips, anyone can achieve financial wellness.

Associated Bank knows you need to remain flexible in this environment. And capital expenditure facilities can allow you to do that in this ever-changing labor market,” says Adam Lutostanski, Head of Illinois, Missouri and Ohio Commercial Banking.

Though you have safety measures in place, and perhaps even a functioning emergency fund, financial setbacks can sideline your small business. Whether because of a business misstep or an unforeseen occurrence that has interfered with your workflow, setbacks can add financial stress to your business in all sorts of ways.

As you continue to enter new phases of your life, you are likely to come across new expenses. This has always been a financial reality, but as you age and your responsibilities increase, this financial reality may become more frequent.

Having a baby is a joyous occasion, but it’s no secret that children can be costly. However, revisiting your financial plan and establishing a new budget for something like this is a celebration in and of itself.

The importance of emergency funds includes the ability to meet basic needs in the event of an unforeseen life event, such as a job loss. It’s also necessary to consider other aspects such as continuation of lifestyle, protecting wealth, avoiding debt and more.

Debt and instant credit are part of our everyday lives. But what’s the balance between using it wisely and having your debt spiral out of control? Here are the two main kinds of debt and credit that you’re most likely to use, and what they involve.

The importance of having—and sticking to—a budget is no secret, and there are plenty of resources available to help you get started. However, once that budget is created, what comes next?

The old phrase “If it ain’t broke…” can easily apply to finances. However, when it comes to banking and managing your money, it might be time to retire this saying

Women’s savings plans—what to keep in mind when you’re a woman looking to save.

After years of a tight labor market, small and mid-sized businesses are now facing a radically different recruitment landscape. The available talent pool is deeper than ever before, and the number of skilled candidates has never been higher.

During times of uncertainty, many small businesses find bill payments, invoicing, disbursements and managing cash flow difficult. These concerns can be overwhelming but knowing which products and services are available to you can make managing your day-to-day cash flow easier, even with increasing transfers and deposits.

Some simple tips for budgeting and savings? We’ve got them. It’s easier than you think to get started with a simple budget and start saving toward tomorrow.

In a recent interview on WGN, SVP and Senior HR Consultant Bret McKitrick shared his perspectives on the topic of employee testing and explored the best practices and legal ramifications around their use.

For years, employers have administered personality assessments, or integrity tests as they’re sometimes called, when screening applicants and new hires. Their aim is to point out traits, characteristics or even temperaments that can predict the employee’s fit in a company culture, or their potential for success.

Because some work can be performed from nearly anyplace with a Wi-Fi connection, there’s less of a need for the traditional office space. Some workers may even report to and interact with supervisors hundreds of miles away. Other companies, particularly startups, are now doing business out of the next generation of offices: the shared space.

Clients are relying on bank expertise perhaps more than ever. One way banks can help clients is with understanding exchange rates and making smart decisions around which currency – U.S. dollars or another currency – is most appropriate to use in a given business transaction.

According to Doug Myers, Chicago Private Client Market Leader with Associated Bank, putting together a plan for managing wealth means ascertaining client desires for the future.

Early 2026 Performance Extends Beyond Tech

A Health Savings Account (HSA) is a tax-advantaged savings and investing account you can use to pay for qualified medical expenses with tax-free dollars, today or in the future.

- HSAs offer triple tax advantages: tax-free contributions, tax-free growth and tax-free withdrawals for qualified medical expenses.

- You must have an HSA-qualified high-deductible health plan to contribute.

- The funds are yours permanently—they roll over every year and stay with you through job or plan changes.

- HSAs can act as a long-term investment vehicle for future healthcare costs, including in retirement.

- Contribution limits, eligible expenses and rules are defined by the IRS and updated annually.

A personal financial planner not only helps you save for your goals, but this partnership can give you peace of mind and make you a more confident investor.

- US Economy Marches On—Government shutdown and tariff shock couldn’t stop the US economy from above-trend growth.

- Great Year for Bonds and Stocks—Quiet yet volatile finish capped off a year that produced upper single-digit bond returns and a third consecutive year of double-digit returns for the S&P 500.

- Uncertainty at Federal Reserve—With Chairman Jerome Powell’s term ending in the next several months and economic data mixed, the Federal Reserve appears unusually split on the direction of monetary policy.

Artificial intelligence (AI) is transforming both the tools used to combat fraud and the tactics fraudsters employ to exploit businesses. Understanding this evolving landscape is key to protecting your organization.

At a glance (quick compare)

- Cost: Passive is typically lowest; active varies and is usually higher.

- Taxes: ETFs often minimize distributions; active management can manage taxes with harvesting/SMAs.

- Control: Active allows custom constraints (legacy positions, values screens); passive is rules-based.

- Effort: Passive is “set it and forget it”; active is more hands-on.

- When it shines: Passive in long bull markets; active when you need customization or have constraints.

Wondering what your monthly payments could look like with a home equity line of credit? Our HELOC payment calculator helps you estimate costs based on your available home equity, interest rate options and loan amount—so you can make smarter borrowing decisions before you commit. Enter a few simple details to preview your potential payment range and borrowing power.

Choosing and implementing a new ERP system is just the first step; ongoing refinements with your vendor are essential while ensuring the system aligns closely with your business processes and goals.

Use this closing cost calculator to estimate your overall closing expenses for buying a home. In just a few steps, you’ll get a personalized estimate based on your home price, down payment and state.

Employers sponsoring retirement plans may be fiduciaries. This article breaks down what fiduciary responsibility really means for employers, from acting in employees’ best interests to monitoring fees and documenting decisions.

- Use 4% and income multiples to size a starting target; then adjust for taxes, healthcare, longevity and sequence risk.

- If you’re behind, pull the big three levers: raise savings, shift retirement age right-size spending.

- Coordinate Social Security timing, withdrawal method and asset mix so cash flow stays reliable.

- Validate with a personalized projection before committing to a plan.

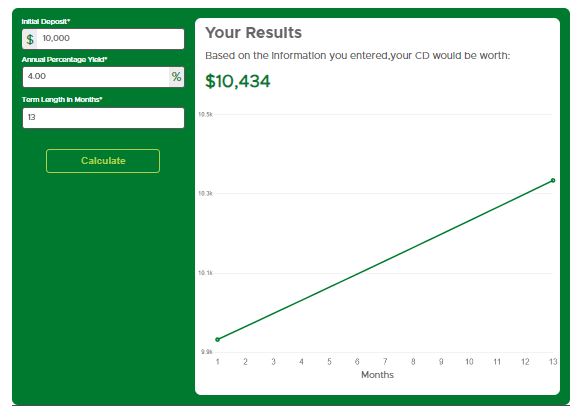

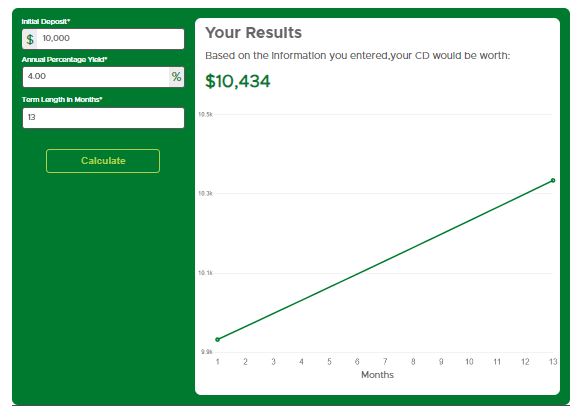

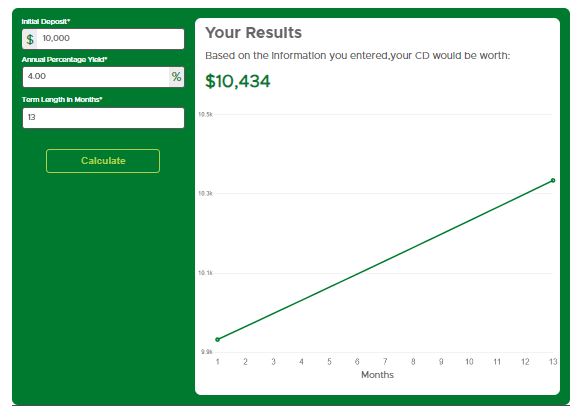

Use our CD calculator to see exactly how much your certificate of deposit (CD) will be worth at maturity. Enter your deposit, APY and term to get your final balance and interest earned in seconds. Compare different rates and terms to find the best fit for your timeline. No guesswork—just clear numbers to guide your choice.

-

Checking accounts offer easy access to your money for everyday spending, including bills, groceries, and online payments.

-

They typically have low or no interest, making them best for short-term use—not long-term savings.

-

There are multiple types of checking accounts (e.g., traditional, student, business) designed to match different financial needs.

-

Understanding and avoiding common fees—like overdraft or ATM charges—can help you manage your account more efficiently.

Phishing continues to be one of the most common and damaging forms of cybercrime. At Associated Bank, we are committed to helping you stay informed and secure. Whether through email, text, phone calls or fake websites, phishing attacks are designed to trick you into providing personal information, such as your banking credentials, credit card numbers or Social Security number. Understanding how phishing works and how to recognize the signs can help you protect yourself and your finances.

At Associated Bank, your security is our top priority. As technology advances, so do the tactics used by cybercriminals. One of the most effective—and dangerous—methods of fraud today is social engineering. Understanding what it is and how to recognize it can help protect your personal information and finances.

Today’s retirement landscape demands a more dynamic approach as longer lifespans, rising costs and market volatility make traditional strategies less reliable. With personalized planning and the right support, individuals can take control and build a retirement that fits their unique goals and lifestyle.

Learn how to use your flexible spending account (FSA) to save on orthodontia costs with helpful tips on claims, documentation, payment options and more.

Consolidating high-interest credit card debt with a low or 0% APR card can simplify payments, cut interest expenses and help you regain financial control.

This clear, concise banking glossary can help you understand the most important banking terms, so you can more confidently communicate with your bank.

An effective wealth plan aligns goals with risk tolerance, inventories assets and adapts over time—offering clarity, resilience and lasting financial confidence.

An enterprise resource planning (ERP) system lets you efficiently and accurately access your company’s operational data. The second of a three-part series on ERPs, this webinar from May 7, 2025, details implementing the ERP you've chosen.

Paying off short-term debt may feel challenging, but with focus, discipline and a clear strategy, it can become an achievable task.

The decision between traditional banks and FinTech companies comes down to your preferences and priorities. Assessing your financial goals and exploring options will help you determine your best solution.

Opening your children’s first bank account could likely be the best way to save money for your kids while simultaneously giving them the tools they need to achieve lifelong financial success.

Family banking is a self-created financial system that helps families manage and grow wealth across generations that supports responsible financial habits and creates opportunities for future generations.

The holidays bring joy—but also expenses. Learn how a dedicated savings account can help you plan for holiday costs, avoid debt and budget for major expenses year-round.

Discover how to teach kids about money at every age, from introducing value through everyday transactions to guiding teenagers in budgeting, saving and understanding credit—laying the groundwork for future financial independence and stability.

This article covers essential steps for married couples to navigate financial decisions, including setting goals, understanding tax implications, managing student loan debt and updating personal information.

Take control of your family’s financial health with this comprehensive annual check-up guide. We’ll help you identify areas to reduce expenses, grow your savings and plan for major life milestones, from education funds to retirement.

Businesses must stay agile by leveraging market research, innovation and customer insights to navigate changing conditions and turn uncertainty into opportunity.

Tax planning is not only a smart financial habit, but it can also make a big difference in shaping your year-end tax returns and tax liabilities. Implementing tax strategies throughout the year can help you take full advantage of all tax-saving opportunities. These 5 Key Tax Tips will help you take control of your year-end tax filing and maximize the money in your pocket.

With markets at or near record highs, economic uncertainty, fluctuating interest rates, geopolitical risks and a new administration taking office, investors are understandably questioning their next steps.

Fraud and cyberattacks are a continuous threat to businesses of all sizes. Our goal at Associated Bank is to provide you with information and tools that can empower you to prevent and secure your systems against these attacks.

Think you can spot a scam? Learn the terms scammers use—like phishing, ransomware and fake websites—to protect yourself from online and bank fraud.

Discover seven essential year-end financial tips to maximize tax benefits, boost savings, and plan for the future. Start the new year strong.

The beginning of a new plan year is an opportunity to set your team and your employees up for success all year long. We can show you how!

Most banks offer notary services to customers, making them the easiest and simplest option for finding a notary public near you.

Merchant services is an umbrella term for the different payment-related software and equipment your business needs to accept credit, debit and online forms of payment.

Check fraud has been on the rise in recent years, leading many businesses to take steps to detect and prevent cases of fraud.

First-time homebuyers have access to special benefits that can help ease them into the homebuying process.

Accounts receivable management is the process of monitoring and collecting any money owed to a business for goods or services paid for on credit. Learn more about accounts receivable.

Customer loyalty programs are a powerful way to increase brand awareness and customer retention for your small business.

Discover how educating employees about Health Savings Accounts (HSAs) can enhance financial wellness, increase enrollment and drive cost savings for both employees and employers.

A home equity line of credit (HELOC) offers financial flexibility to pay for household projects as well as education, paying off other debts and more. But once you’ve applied and been approved, what comes next?

Planning for retirement is important, and it’s never too early do so. Even if you’re many years from retirement, you should be saving now.

Small Business Saturday is an annual tradition that emphasizes the importance of small businesses in the American economy.

Learn how changing short and long term interest rates can affect your company's balance sheet and income statement, and how to manage your interest rate exposure with bank products like fixed and floating rate loans, interest rate swaps, and other hedging tools.

How new technologies are reshaping industries and the workforce and what it means for the future of business.

Explore personalized wealth planning for every life stage, from growth to retirement. Elevate your financial future with our expert-guided strategies and tools.

The SECURE Act 2.0 introduces several key changes to retirement and savings accounts for Americans

The term “retirement readiness” refers to the degree to which an individual has financially and legally prepared themselves for retirement. Learn more about how you can determine if you’re ready for retirement.

While both plans have distinct advantages, growing firms will often convert their SIMPLE IRA offerings to 401(k) plans due to the higher contribution limits and increased flexibility.

Finding the right investment manager can be a long and complex process, but the reward is a partnership that can last decades.

Milwaukee's makeover - blending arts with enterprise

If you missed it, check out this video for an in depth conversation on the current state of the US interest rate market. We reviewed how the economy has responded to higher rates so far, evaluated market expectations for both long- and short-term rates and provided business leaders with a road map for navigating risks and opportunities as the current interest rate cycle enters a new phase.

Nonprofits partner with banks to access treasury management services, lending options and specialized accounts that fit their size and automation needs. But the relationship can be more than that. Together, they can reach community goals and the people and causes these nonprofits serve.

Learn how to report your debit card lost or stolen.

Explore the implications of the impending sunset of the elevated federal estate tax threshold and strategies to navigate this significant financial change.

The shifting of roles can be challenging, and emotions often prevent important information from being exchanged and critical decisions from being made.

Learn how to use Actionable Insights

When the assets of an estate can be expected to appreciate, one tool for preserving the value of those assets is termed the Defective Grantor Trust. It is not only a technique for dealing separately with income tax and estate tax, but also an example of the beneficiaries of an estate receiving the full value available.

While it’s difficult to predict what type of care any one person might need or how long he or she will need it, statistics reveal women need for care are averaging longer at 3.7 years to men’s 2.2 years. (20% will need care for more than five years.

The Charitable Lead Annuity Trust, or CLAT, is an irrevocable trust that offers benefactors a way to contribute payments to a charitable trust, a donor-advised fund, or a foundation of the grantor’s choosing for a specific term of years or for the lifetime of the grantor, with the balance distributed to the grantor’s descendants or other beneficiaries at the end of the specified term.

Generally speaking, you should save roughly 20% of your gross income for retirement and other savings goals per month.

Estate planning documents are essential because no one can predict the future. But one thing is sure: If we leave unanswered questions about how to settle our affairs, life for those we love could be even more difficult. Below are brief descriptions about each of these estate planning documents and what each does.

Choosing a bank is an important decision, so you’ll want to look at several factors that can impact your choice.

Partnering with a dedicated HSA provider is an excellent way to increase employee enrollment and engagement in your organization’s HSA plan.

If you find fraudulent charges on your account, you should immediately contact your bank to report the issue.

The main differences between health savings accounts (HSAs) and flexible spending accounts (FSAs) are account ownership and portability.

Learn five essential tips you need to know to figure out the best way to track your spending and stay in line with your budget.

A 401(k) is a tax-advantaged investment account commonly offered by employers as a retirement savings benefit to employees.

Charity Olson, SVP Personal Trust Manager discusses how to prepare for year end in terms of financial planning.

You can quickly and easily find your bank routing number by checking the nine-digit code in the bottom-left corner of your personal checks.

An estate plan could include a trust, will, powers of attorney and beneficiary forms. Ensure you have everything else you need to ensure your loved ones are in the best position to manage your estate.

Associated Choice Checking offers a set of exclusive benefits called Platinum Choice that you can unlock once you reach a certain threshold in your balance.

Charitable giving continues to grow as an active component of people’s lives and finances, especially for women. Having a strategy in place is important to make the most of your charitable giving and financial planning.

Learn how to reset your password

Play this short demo to learn how to unlock your account in digital banking

Learn how to pay a bill

Learn how to set up account alerts and quiet time

Learn how to enroll in digital banking

Learn how to make a mobile check deposit

Learn how to set up recurring payments

Learn how to navigate through Quick Access

Learn how to transfer funds between accounts to make a loan payment

Learn how to transfer funds between accounts to make a loan payment

Learn how to edit a payee

Play this short demo to learn how to add a payee in digital banking

Many of today’s “senior citizens” are living independent lives longer than past generations. They’re active in their communities, help with the grandchildren and keep physically fit. They browse the internet and participate in social media. But they can still be subject to scams, frauds and other financial crimes.

Erika Gudgeon has always been passionate about sports, fitness, and helping people feel better about themselves. She wanted to not only share her passions and experience but teach people how to use their workouts as an effective stress reliever.

Metric Forrest Studio connected with the Wisconsin Women’s Business Initiative Corporation (WWBIC), which loaned them money to support their business. In 2021, they received additional support with a $5,000 grant from Associated Bank and Brewers Community Foundation.

In this webinar, Lori Novak and Angie Kappel discuss the best ways to use foreign exchange to boost your business.

There are significant differences between a HELOC (home equity line of credit) and a home equity loan. Learn how to choose the right option for your needs.

For many people, renting a home vs. buying comes down to a few simple factors, including lifestyle preferences, monthly costs, and lifetime costs. In this article, we’ll look at the pros and cons of renting and buying, and which is right option for you.

Electronic data breaches have become an increasingly common occurrence these days, causing fears among consumers and leading many to look for the appropriate precautionary measures. We reveal the ways financial institutions and individuals alike can help protect themselves.

Protecting your business from fraud, starts with protecting yourself from fraud.

Featuring David DeChamps from FID discussing the importance of being aware of fraud and how to protect yourself from schemes.

Your credit score is the one of the most important and easiest ways to quickly determine your financial health.

Need to make a big purchase? Distinguish between "needs" and "wants". This guide will help you learn to save money using a sinking fund: set an amount, timeline and automate savings in a separate account. Tools like Associated Bank Digital's Money Monitor assist in optimizing savings. Achieve dreams without financial stress.

You’ll find the house buying process to be thrilling and rewarding. But, it can also be daunting and confusing at times. This article will walk you through how to prepare to buy a house, from getting your finances ready to signing on closing day.

Bitcoin and cryptocurrencies are among the most revolutionary trends in the financial world right now, but to the general public, they’re still somewhat of a mystery. While its decade-long development has seen fits and starts, “crypto” has taken a toehold on the market—even in areas where everyday consumers might begin to see its use and effects.

Your financial situation, just like your life, is unique. You have your own interests and your own plans for the future, and your investments should not only help you reach the future you envision, but they should align with these interests as well.

Online digital banking tools like Associated Bank Digital have features and advantages for better account management from your computer or mobile device.

According to some studies, a typical business loses about 5% of annual income due to one infuriating cause: fraud.

When putting together a budget and establishing your financial plan for the future, there are many factors to consider. After all, a budget doesn’t only account for your monthly expenses, but your goals as well, even if they aren’t yet within financial reach.

Having a solid balance in your savings account or an impressive credit score are not achievements that happen instantly. In fact, quite the opposite. Being financially sound is a goal that takes smart and ongoing spending and saving habits.

Credit can be a powerful financial asset to have on your side, making you more attractive to lenders and enabling you to secure better rates on loans you might need. But having good credit (and more specifically, a good credit score) is something that is achieved, not something that is simply provided or assigned to you.

We know that understanding how to protect your money is a top priority for you. We’re here to offer some easy suggestions to help you feel a sense of security.

Attendees of the recent treasury and cash management conference, the Windy City Summit, covered discussions on treasury management trends like rates, cards and real-time master payments, but one topic continued to be a significant threat that touches on nearly every conversation, especially those that focus on technology: fraud.

ACH payments have made headlines in the corporate banking space, as they’ve recently gotten speedier for corporations in the United States. Chuck Garcia, Former Director of Commercial Deposits and Treasury Management at Associated Bank, provides a bit of context around the use of ACH payments over the years.

With their diplomas and degrees in hand, another group of graduates is off to tackle the world of “adulting.” Whether they’re making the transition to a college campus or that first real job, they should have a firm grasp on the basics of financial literacy—but do they?

Financial advisors operate in a variety of capacities—some are more focused on saving and investing, some are more equipped to handle high-net-worth needs like estate planning and business succession and some are online robo-advisors—but the key elements remain the same.

Everyone looks for trends, for what's big, for what's at the forefront of conversation when the calendar turns the page to a new year. Doug Myers, Chicago Private Client Market Leader with Associated Bank, pinpoints wealth management as a top financial industry topic this year.

Each month, Associated Bank's experts dive into finance and business topics, from local real estate to global economic trends and politics' effect on the economy. We bring together leading voices in the fields of commercial real estate, capital markets, commercial banking and private banking to share their insights and expertise to help you stay informed.

Upcoming movements by the Fed and their influence on inflation and labor market trends are the subject of this webinar, recorded in February of 2026.

AI is transforming fraud and cybersecurity. Learn how AI-driven fraud detection, deepfake prevention and layered defenses help businesses stay ahead of evolving threats.

In this article, our internal investment research teams describe how AI-related spending trends have escalated over the last six months, identify some of the uncertainties and risks to monitor that could impact valuations.

Use our savings account interest calculator to see your ending balance and total compound interest in seconds. Enter your deposit, compare up to three annual percentage yields (APY), choose the number of years and get side-by-side results. Pick the rate that pays you more-no spreadsheets.

Associated Bank expands railroad banking, sharing insights on growth, tech and ERP trends at the 2025 ASLRRA Meeting.

Use this interest rate mortgage calculator to get an estimate on your monthly mortgage payment over the life of the loan. Fixed-rate loans are commonly offered in 10-, 20-, 25- and 30-year terms. Enter details here.

Learn how to plan your healthcare FSA contributions and use Associated Bank’s calculator to estimate medical, dental and vision expenses.

With recent changes in tax laws and shifting interest rates, along with continued uncertainty around U.S. fiscal spending and trade policy, this is a critical moment for investors, business owners and decision makers to take strategic action that can help pave the way to long-term success.

The right knowledge takes AP automation from overwhelming to empowering—driving progress and lasting improvements that can boost your business.

Keeping all your accounts at one financial institution has its benefits, from better rates on your savings, fast transfers, fewer fees and improved security to a stronger overall relationship with your bank—and your money.

Compound interest is the engine that turns small, steady savings into significant wealth. By earning interest on both your original deposit and the interest it generates, your balance grows over time. The key drivers are starting early, contributing regularly and letting your earnings stay invested so they can compound again and again.

From a recent Associated Bank webinar with Elan Financial and PaperTrl: Explore B2B payment methods, compare traditional and digital options, as well as security and implementation strategies to optimize payables and boost efficiency.

Struggling with loan payments? Financial challenges can feel overwhelming, but assistance programs like loan modifications and repayment plans can help.

Adding a payable on death (POD) beneficiary is a convenient financial arrangement that lets you designate someone who, upon your death, will receive your bank account funds with no court involved.

Employees expect a range of benefits they can personalize—so make sure to consider HSAs, HRAs and FSAs. These accounts can add real value to your benefits package.

In this article, we’ll cover the basics of how you can measure the health of your organization’s retirement plan, from evaluating your plan design to making well-informed investment selection and monitoring decisions.

Premium credit cards are more than a luxury symbol—you can leverage their generous benefits into your overall financial strategy.

Refinancing a home loan can lower interest rates, reduce monthly payments, shorten the loan term and provide greater stability by switching to a fixed-rate mortgage. To make the right decision, it’s important to evaluate your goals with trusted professionals.

A financial wellness review can help you align your finances with your goals. It covers budgeting, savings, retirement planning and life changes like marriage or income shifts. With expert guidance, you’ll build—and understand—a stronger foundation for long-term financial confidence and success.

Investors are concerned with the national debt and fluctuating interest rates. This article explores how these affect their financial outlook.

This article explores strategies to help you regain financial stability and achieve long-term freedom from debt. With practical tips and expert guidance, this article can help you choose the best path for your financial goals.

Discover five clever and practical ways to save money and take control of your financial future. Learn to shop smart, cut recurring expenses and make saving a seamless part of your routine.

This timely webinar, led by Associated Bank’s Frank Barbaro, Head of Interest Rate Derivatives, and Mitch Clements, Head of Corporate Foreign Exchange Advisory, took a look at navigating these challenging times.

This guide explores three easy ways to file your taxes. Learn how to simplify tax season, save time and maximize your refund by choosing the right approach for your financial situation.

Bank fraud is an increasingly common issue that can affect anybody. This guide will help you understand bank fraud, spot warning signs and report fraud effectively, ensuring your assets are properly safeguarded.

The "pay yourself first" involves setting aside a portion of your income for savings or investments before addressing other expenses, ensuring consistent progress toward building wealth.

Discover how to invest for retirement with tax smart strategies to grow your savings and secure your future using 401(k)s, IRAs, Roth IRAs, and HSAs.

Tax scams are attempts to steal your money or personal information often by impersonating the IRS or promising fake tax benefits. When in doubt, pause, verify the source and report any suspicious activity.

Credit card debt can quickly grow to become an overwhelming obstacle, especially with the average interest rates for credit cards hovering between 23% and 29% APR. The good news? By creating a clear strategy and committing to reducing your debt, you can make significant progress on paying off credit card debt fast. This article provides seven proven methods to help you pay down credit card debt efficiently, reducing stress along the way and maximizing the effectiveness of each payment.

The 2025 housing market will face affordability challenges but may see slower price growth and opportunities in new construction and regional markets.

Watch our webinar with Tom Toerpe, Senior Vice President - Capital Markets for insights on the impact of tariff threats on markets, trade, inflation and rates.

Uncertain markets and rising costs demand a strategic approach to cash management and investing. Discover key opportunities, risks and actionable strategies to optimize your portfolio. Learn how staying invested, diversifying thoughtfully and aligning with short and long-term goals can help you navigate today's challenges with confidence.

By being proactive about your online and financial security, you can minimize the risk of encountering scams and protect your personal information from fraudsters.

In today’s volatile landscape, fraud and cyber-attacks continue to plague businesses across all industries and sizes. More than ever, it’s important to stay up to date on the new ways fraudsters are testing systems for unseen vulnerabilities and using their findings to attack them.

While you may know COBRA, are you aware of all the rules for your organization? Overlooking state continuation laws can be costly. Here's what you need to know.

Watch our webinar with Tom Toerpe for insights on the Fed’s rate cut and strategies to navigate shifting financing costs for borrowers and investors.

Parents who want to help their teenagers open checking and savings accounts should look at the different joint and custodial account options available at their local bank.

Choosing the best bank for your nonprofit will depend on several factors, from the minimum initial deposit to the presence of brick-and-mortar locations.

Starting a successful business means planning for the legal and financial hurdles that may impact your profitability or operations down the line.

Finding the right business checking account for your organization can help streamline your finances and grow your business.

Your credit score is an essential part of building financial security and accessing favorable rates and terms from lenders.

Creating a plan to monitor and check your credit score regularly will help you stay on track to achieving your financial goals.

Improving your cash flow can often be a challenge for business owners, especially when it comes to increasing sales and driving stronger profitability.

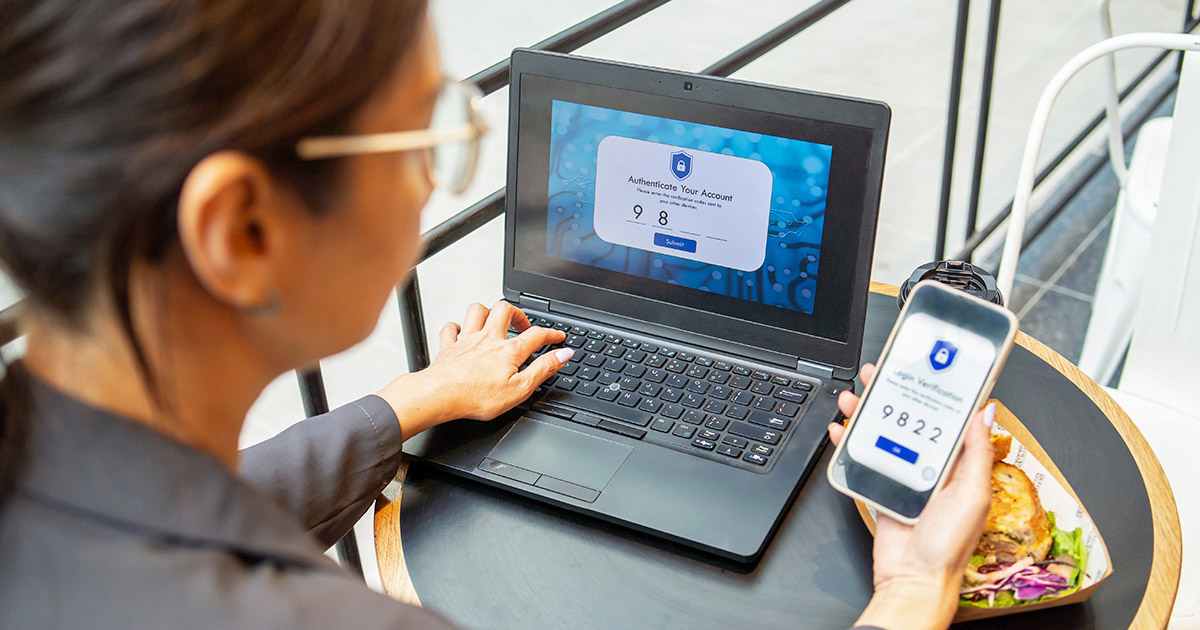

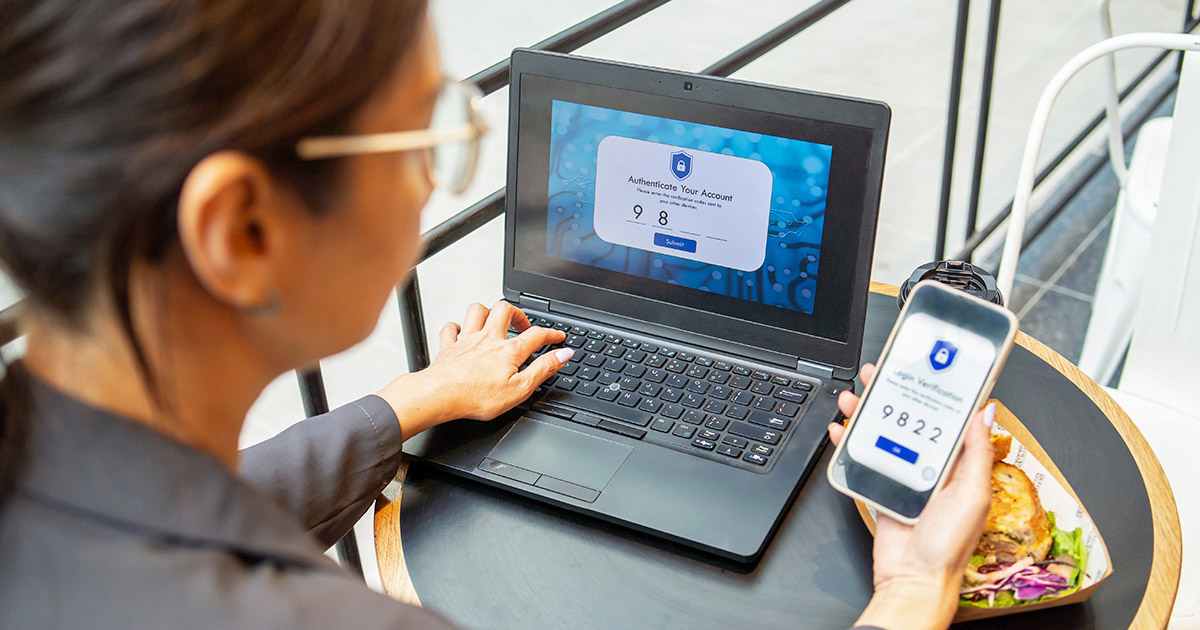

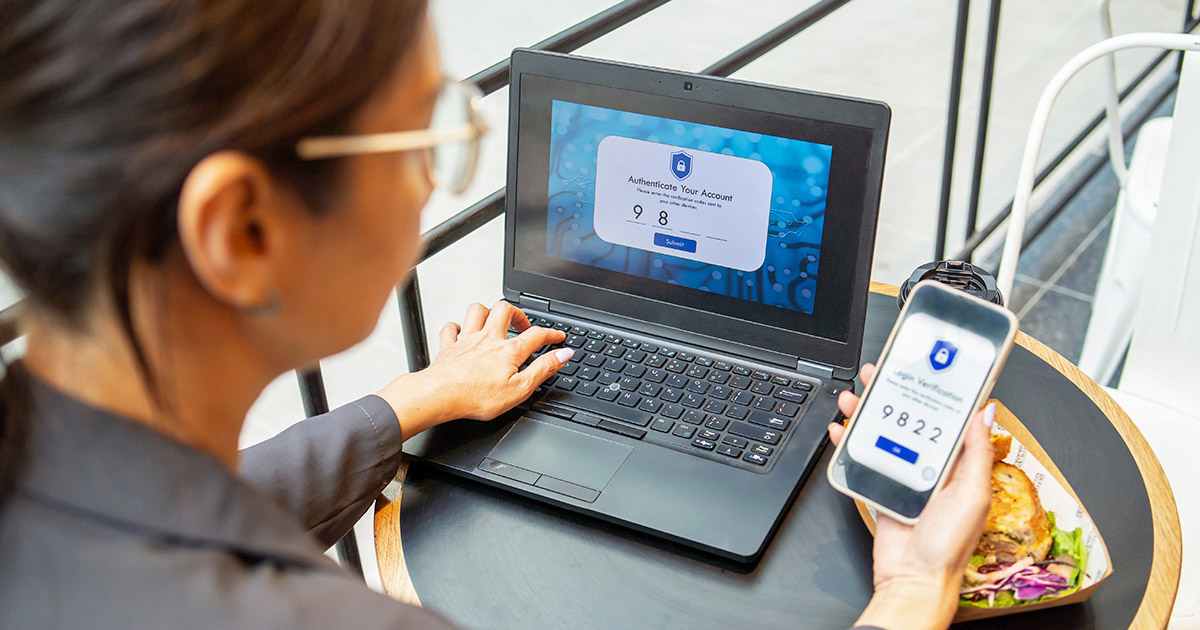

Multi-factor authentication (MFA) is a security measure that requires you to navigate a two-step process to prove your identity before logging into an account. This additional layer of security helps ensure that even if your password is compromised, unauthorized access is still prevented.

A well-managed accounts payable process can improve your business’s reputation and make it easier to acquire the goods and services you need to succeed.

Health savings accounts (HSAs) are a convenient way to cover the costs of healthcare. Certificates of deposit (CDs) are known for their security and stability. Combine the two, and you can accrue interest, let them grow for years, and effectively build long-term savings for healthcare and more.

Discover how the US economy thrives amid Federal Reserve challenges.

Strengthen your defenses against online fraud and cybercrimes with 10 simple tips.

Markets have had a strong start to the year and are already setting new records. On February 9th, 2024, the S&P 500 marked a new record high crossing 5,000 for the first time. The widely followed S&P 500 is the benchmark index that tracks 500 of the largest U.S. publicly traded companies.

The primary benefit of a safe harbor 401(k) plan is that it provides for the automatic passage of annual nondiscrimination tests that can otherwise limit the contributions made by certain company owners and other highly compensated employees. Learn more about the advantages of these plans for your business.

Did you know there are things you can do to get more out of your account(s)? Let us show you how!

Nonprofits face unique challenges when it comes to asset management. Check out this article to learn more about how a nonprofit can benefit from partnering with an institutional asset management firm.

Learn more about what ESG investing is and the role it plays in your overall portfolio by reading this article from our resource center. Link in our bio.

Fraud continues to be on the rise, and with new schemes emerging frequently, it's difficult to know if your company, customer, colleague and vendor data are protected. Your business stores sensitive, personal data, which is valuable information for criminals, but may have detrimental impacts on those whose information has been compromised. Being well informed is one way to keep your business and those you do business with safe from fraudsters.

Learn how to use Activation Zone on your phone.

Your hard-earned financial assets deserve personalized wealth management. Finding a trusted local team of specialists is crucial. Here’s why you should select a private banker who delivers the right combination of dedication, unbiased advice, comprehensive strategies and financial and wealth planning solutions, designed around you.

Create a special needs trust and appoint a trustee for your financial plan.

Unlock the benefits of Charitable Gift Annuities and Legacy IRA QCDs under the new SECURE Act 2.0 guidelines with our accessible guide.

We all make mistakes. The key is to learn from them and try not to repeat them. Financial mistakes can be particularly costly and can have long-term implications. Throughout my career, I’ve witnessed plenty of missteps and “I wish I hadn’t done that” moments. I thought it might be helpful to share some of the most common.

Learn how to use Actionable Insights

Making up for lost time and sales resulting from the supply chain crisis, most manufacturers increased orders in hopes of catching up. However, now that suppliers are able to ship and deliver, a new issue has arisen: dealing with increased inventory levels.

Investing in a recession comes with concerns, but patience and adherence may be the best approach. Associated Bank Private Wealth help clients handle whatever the markets throw at us.

Play this short demo to learn how to lock and unlock your debit card in digital banking

Time in market beats timing the market. Waiting will likely lead to continued procrastination. Associated Bank Private Wealth can help you pursue your financial goals.

Women who share money management duties with their partner tend to take on a lion’s share of the responsibility for the household finances. Yet only 18% of women feel very confident in their ability to fully retire with a comfortable lifestyle.

By following a few basic tips, you can stay safe when online banking and stay on track toward your financial goals. In this article from our Resource Center, we cover five powerful tips you can implement today to ensure your funds stay secure

The primary benefit of an HDHP is the potential to help you save money on insurance premiums each year and pairing with an HSA.

Check out these six quick tips you can use to improve your financial health and work toward your future goals.

A high-deductible health plan (HDHP) is a form of health insurance that trades higher deductibles for lower premiums.

A vast opportunity presents itself today, more than ever, for businesses to become more resilient and agile by aligning their supply chains. Years ago, proximity to resources, access to markets and conventional transportation were enough to fuel growth and prosperity. In the past century, dynamics have shifted and what once would position your company for success, may not be enough now.

Ensuring you have enough money for retirement might not be as important in your 20s and 30s as it is in your 40s and 50s. However, any progress you make in your early years can have an enormous impact on the size of your nest egg come retirement. Check out this article from our Resource Center to learn more about compounding interest and why investing early and often is the best strategy for meeting your retirement goals.

Learn how to write a check by following six basic steps, from filling in the correct date to signing the check at the end of the process.

Learn how to choose the right checking account by following a few basic tips such as looking for low fees and online banking options.

Purchasing your first home can be both exciting and complex, and you may need help figuring out where to start.

For Small and Medium-sized Enterprises (SMEs), critical expertise or support may be missing when doing international business with a provider. It’s important for SMEs to find a foreign exchange (FX) provider that fills the void.

While there are several strategies for paying off your debt, it all comes down to one key word: balance.

Play this short demo to learn how to unlock your account in digital banking

Learn how to set up account alerts and quiet time

Learn how to view transaction history

Learn how to delete a payee

Learn how to delete a payee

Learn how to view and edit your Preferences in Associated Bank Digital, including how to mark accounts as favorites and even turn off accounts you don’t want to appear.

Learn how to view transaction history

Learn how to retrieve your username

Learn how to retrieve your username

Play this short demo to learn how to add an external account or loan in digital banking

Learn How to add an external account or loan in Associated Bank Digital.

Play this short demo to learn how quick and easy it is to sign in to your digital banking

Play this short demo to learn how quick and easy it is to sign in to your digital banking

In today’s uncertain economic times, personal risk management has become a vital component of a cohesive wealth management strategy for affluent individuals.

When circumstances change, even the most solid financial plan needs to be adjusted. Learn about how to strategize for marriage, divorce, estate planning and more.

A home equity line of credit (HELOC) is a very powerful and flexible financial tool, allowing you to borrow funds using the equity you’ve built in your home.

Life is full of surprises. Taking some steps to protect yourself financially can eliminate many of the headaches and hardships associated with emergencies.

According to Associated Bank’s Michelle Long, having a clear picture of your family’s finances can be an intimidating task, but it’s critical for handling both planned and unplanned money management. As a lead financial planner, she’s seen the challenges some of her female clients face and emphasizes the importance of being well-prepared and well-informed.

If you’re in business, you know that opportunities for growth can come quickly. Your ability to secure the right kind of financing can often be the key to making the move or not. Many lenders base their decisions on “the 5 Cs of credit.” Knowing what these involve—and being ready to answer these questions quickly—can put you in the best position to make the most of a promising opportunity.

Julie Niznansky Vice President, Private Banker shares comprehensive financial advice. Julie walks through the steps it takes to build a sound financial foundation, sharing expert tips and advice for individuals at all income levels. Walk away from this one hour webinar feeling more secure and confident about your financial future.

While the five key risks to retirement – longevity, inflation, healthcare, market and withdrawal risk – are common to most retirees, their impact will vary depending upon your particular needs and circumstances.

With commodity costs skyrocketing and fluctuating daily, our clients need more availability to ensure that they can source materials and deliver to their customers. See what Adam Lutostanski says about how Associated Bank takes uncertainty out of the equation

Did you know small businesses are big drivers of the economy? According to the Small Business Administration, there are nearly 30 million of them in the United States, employing 56.8 million workers. Even more impressive, companies with fewer than 500 employees account for 99.7% of all business in the U.S., driving their local economies and enriching local communities.

There are many things worth saving your money for, and most of them likely coincide with your goals. While it is common for people to think of goals as items or situations that would better their lives, they do not have to come in form of purchases.

There are really only two ways to improve your financial standing: make more money or spend less money. The former is a bit trickier and more out of your control, which makes it a bit more difficult to rely on. Spending less money, on the other hand, makes it easier to save. And this option puts you in better charge of your finances, while at the same time, prepares you for the future.

Personal financial planning might seem like a broad concept that encompasses just about every aspect of your financial life. If you don’t have a financial plan in place, this might seem like a daunting effort or perhaps a rigid way to go through your expenses. However, this is not the case. In fact, it’s quite the opposite.

Credit is an easy way to make major and everyday purchases affordable. Sometimes, however, it can be too easy. Spending more than you earn in any given period is a dangerous practice at best.

From the Smart Business Dealmakers Conference, Associated Bank’s John Kvamme and host Dustin Klein discuss the discovery, preparation and exit phases of a sale transaction. They also delve into how sellers can maximize their understanding of these phases to achieve a successful transaction.

When it comes to planning your big day, it’s important that you also factor in the rest of your life. A wedding is a wonderful celebration that you, your spouse and all of your guests will remember for years to come. But you don’t want those years to start out in debt.

There is never a bad time to set a budget, but if you have not already, those early days of financial independence are a great time to get started. As a young adult starting college or gaining workforce experience, you’ll find that having a budget in place will play a more impactful role than it has in the past.

Debt can be a difficult thing to carry around, and if left ignored, it can be a hindrance to your financial planning efforts. And while there are many different strategies for lowering and managing debt, it really all comes down to one word: Balance.

Are you hoping to purchase a home in Bay View, Wauwatosa, Whitefish Bay, Oak Creek or any of Milwaukee’s other vibrant communities?

It can be easy to go over-budget during the holiday season. Use these simple tips to set a budget and stick to it.

Did you know your investments could be in a much lower capital gains tax bracket even though your taxable income is much higher? Don’t feel bad if you didn’t because I talk to many high-net-worth families and individuals who don’t realize there is an opportunity to leverage a 0% tax rate on long-term capital gains.

Many of the clients I’ve been fortunate to serve over the years tell me that recruiting senior executives is one of their biggest challenges. These organizations often fit a certain type of profile. They are successful companies with established track records. They are financially solid, even somewhat conservative. But their headquarters is not located in a well-known city with a reputation for excitement.

Whenever mortgage rates start drifting downward, homeowners’ thoughts often turn to refinancing. Now is no exception. But is it a good idea for your situation?

Commercial real estate continues to make headlines in Chicago, feeding simultaneously into daily water cooler conversations and analyst reports alike, as large-scale renovations begin at Willis Tower, new dorm-style apartments target young professionals and a number of new office spaces, like the swanky 150 N. Riverside Plaza building, open their doors.

"When you take a look at the foreign exchange markets – and they are on a 24-hour basis the way they move around – there is risk that companies, or CFOs of companies, face 24 hours a day," said Don Lloyd, Senior Vice President and Manager of Capital Markets – Foreign Exchange, Rate Swaps and Commodity Derivatives at Associated Bank.

Kevin Warsh has been nominated as the next Federal Reserve Chair. Despite his hawkish background, he now supports rate cuts tied to AI-driven productivity gains, even as job growth slows and the labor market remains fragile.

Markets have reacted calmly. Interest rates and Treasury yields have changed little; the yield curve continues to steepen and expectations for gradual rate cuts remain largely intact despite broader political and market volatility.

Each month, Associated Bank's experts dive into finance and business topics, from local real estate to global economic trends and politics' effect on the economy. We bring together leading voices in the fields of commercial real estate, capital markets, commercial banking and private banking to share their insights and expertise to help you stay informed.

A Health Savings Account (HSA) is a tax-advantaged savings and investing account you can use to pay for qualified medical expenses with tax-free dollars, today or in the future.

- HSAs offer triple tax advantages: tax-free contributions, tax-free growth and tax-free withdrawals for qualified medical expenses.

- You must have an HSA-qualified high-deductible health plan to contribute.

- The funds are yours permanently—they roll over every year and stay with you through job or plan changes.

- HSAs can act as a long-term investment vehicle for future healthcare costs, including in retirement.

- Contribution limits, eligible expenses and rules are defined by the IRS and updated annually.

- A HELOC is a revolving credit line secured by your home, offering flexible borrowing similar to a credit card but with lower rates.

- You borrow during the draw period (typically 5–10 years) and repay during the repayment period (typically 10–20 years).

- Your borrowing limit is based on your available home equity and loan-to-value (LTV) ratio, usually capped at 80–90%.

- HELOCs can fund home improvements, emergency repairs, education, debt consolidation or other major expenses.

- Costs may include variable interest, closing fees, annual charges and early closure penalties.

- You apply by submitting financial documents, completing a home appraisal and reviewing terms with a lender.

AI is transforming fraud and cybersecurity. Learn how AI-driven fraud detection, deepfake prevention and layered defenses help businesses stay ahead of evolving threats.

- US Economy Marches On—Government shutdown and tariff shock couldn’t stop the US economy from above-trend growth.

- Great Year for Bonds and Stocks—Quiet yet volatile finish capped off a year that produced upper single-digit bond returns and a third consecutive year of double-digit returns for the S&P 500.

- Uncertainty at Federal Reserve—With Chairman Jerome Powell’s term ending in the next several months and economic data mixed, the Federal Reserve appears unusually split on the direction of monetary policy.

A clear, proactive succession plan helps nonprofits navigate leadership changes with confidence. Learn how to prepare, communicate and transition smoothly to protect your mission.

Use our savings account interest calculator to see your ending balance and total compound interest in seconds. Enter your deposit, compare up to three annual percentage yields (APY), choose the number of years and get side-by-side results. Pick the rate that pays you more-no spreadsheets.

At a glance (quick compare)

- Cost: Passive is typically lowest; active varies and is usually higher.

- Taxes: ETFs often minimize distributions; active management can manage taxes with harvesting/SMAs.

- Control: Active allows custom constraints (legacy positions, values screens); passive is rules-based.

- Effort: Passive is “set it and forget it”; active is more hands-on.

- When it shines: Passive in long bull markets; active when you need customization or have constraints.