AI Spending Up, Uncertainty and Financial Risk Grow

In this article, our internal investment research teams describe how AI-related spending trends have escalated over the last six months, identify some of the uncertainties and risks to monitor that could impact valuations.

AI spending continues to rise rapidly but with this acceleration come questions of sustainability and potential bottlenecks. How will all this future investment be financed, and can power infrastructure keep pace?

AI spending trends: Who’s leading the surge?

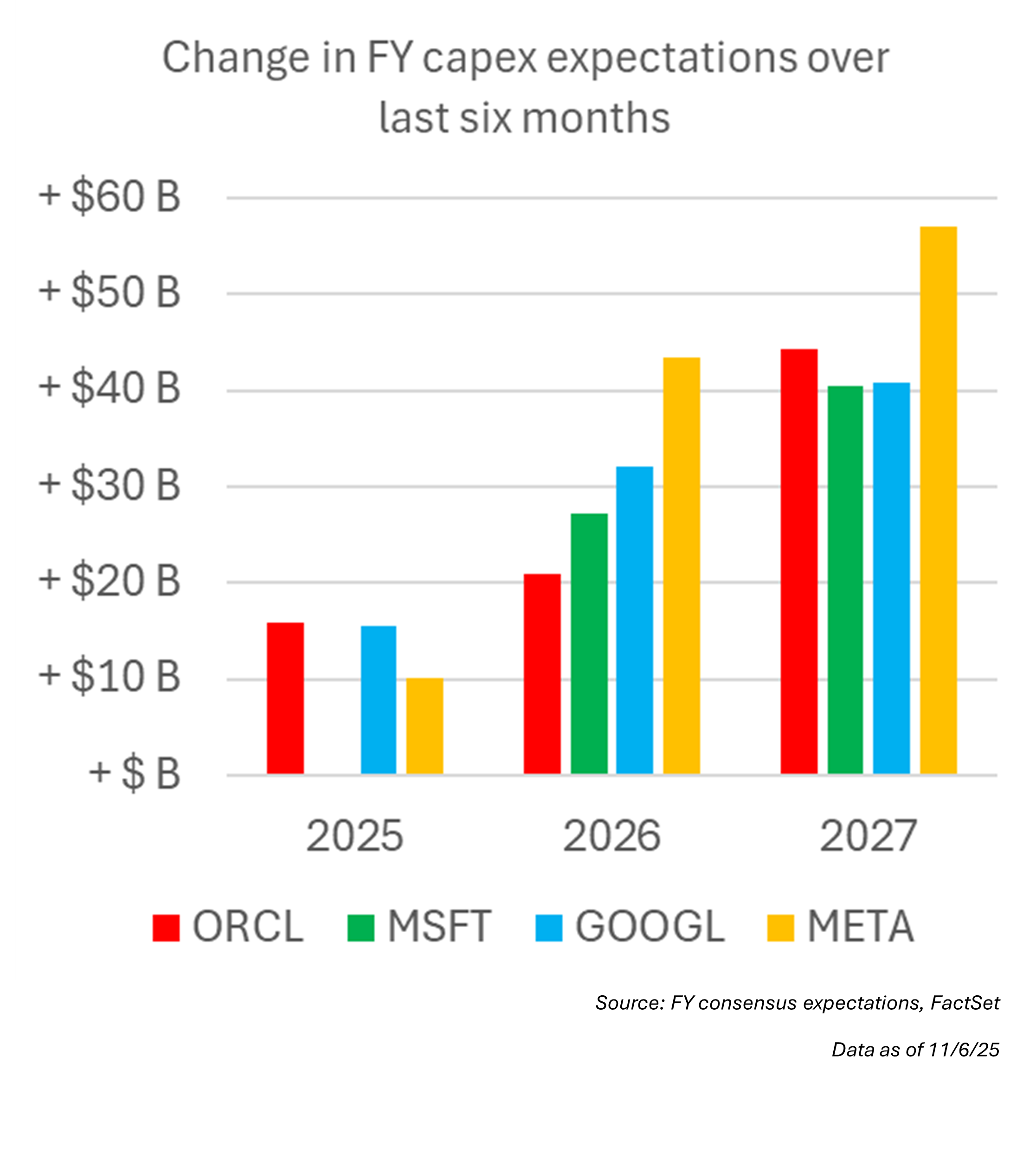

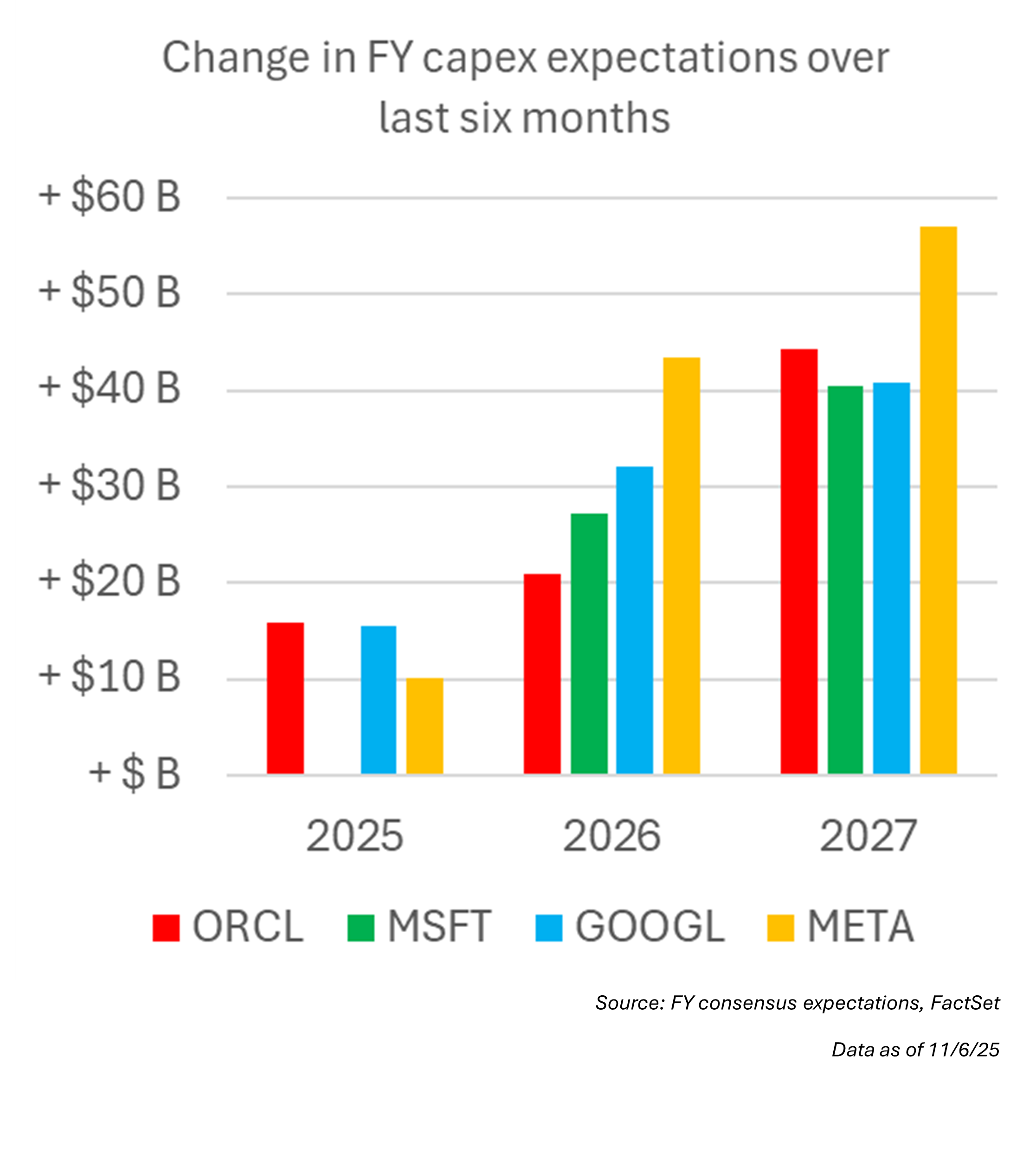

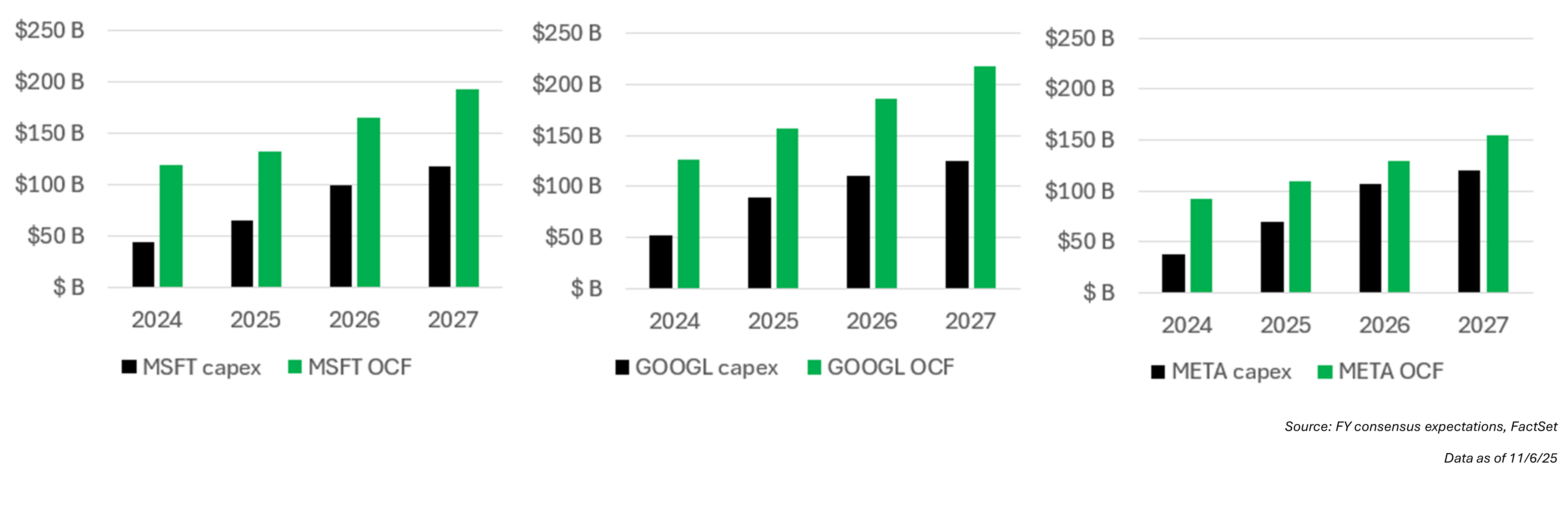

Mega-cap tech companies with more traditional public cloud businesses led a majority of the initial AI spending boom. However, much of the rise in spending expectations is being driven by a different set of tech companies. And while spending expectations continue to increase at the likes of Microsoft (MSFT) and Alphabet (GOOGL), they are rising far more quickly at companies like Meta (META) and Oracle (ORCL).

- Meta’s (META) FY2027 capex expectations have increased by 90% over the last six months, from $63B to $120B, as the company aggressively expands its AI-focused data center capacity under CEO Mark Zuckerberg.

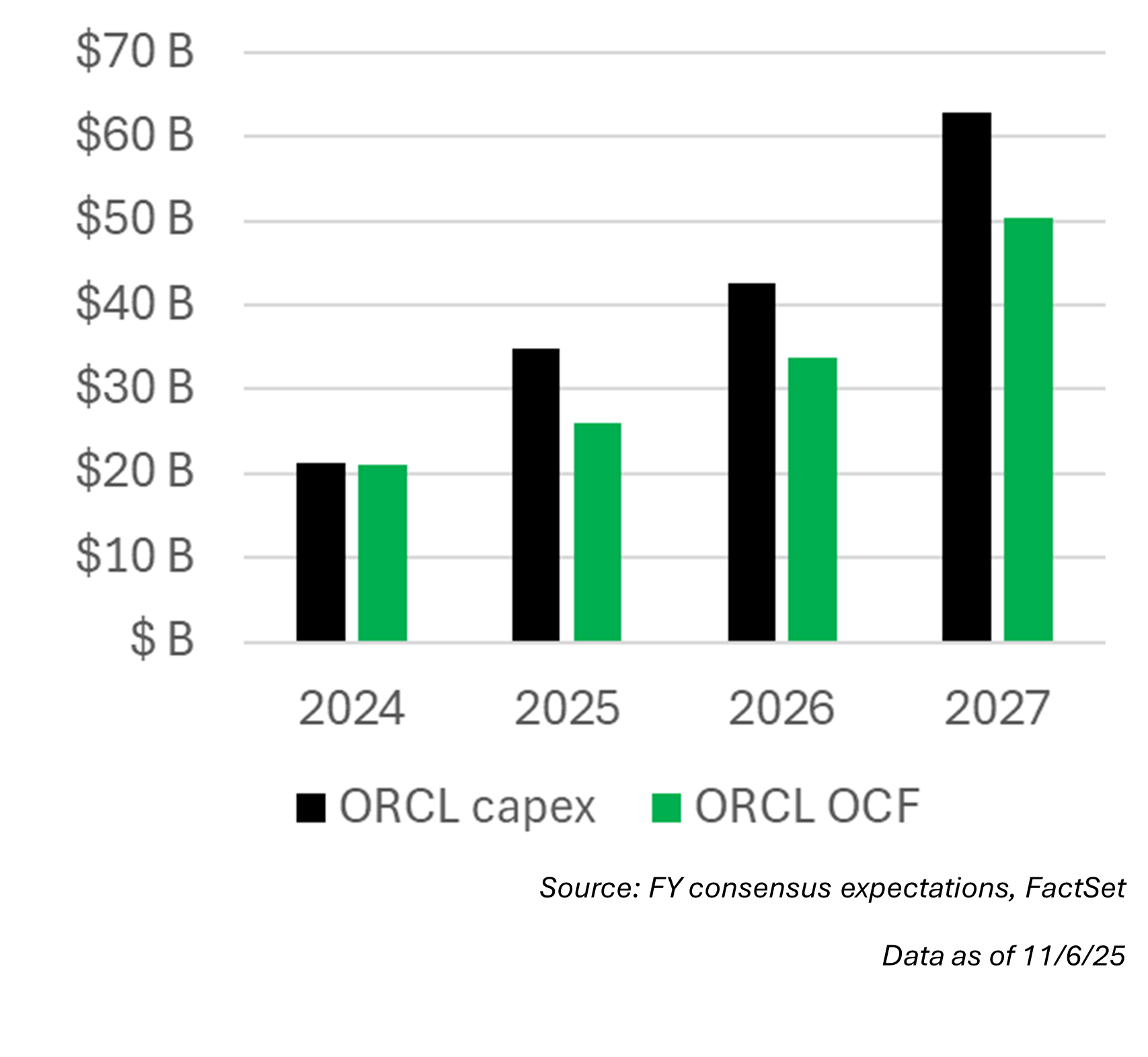

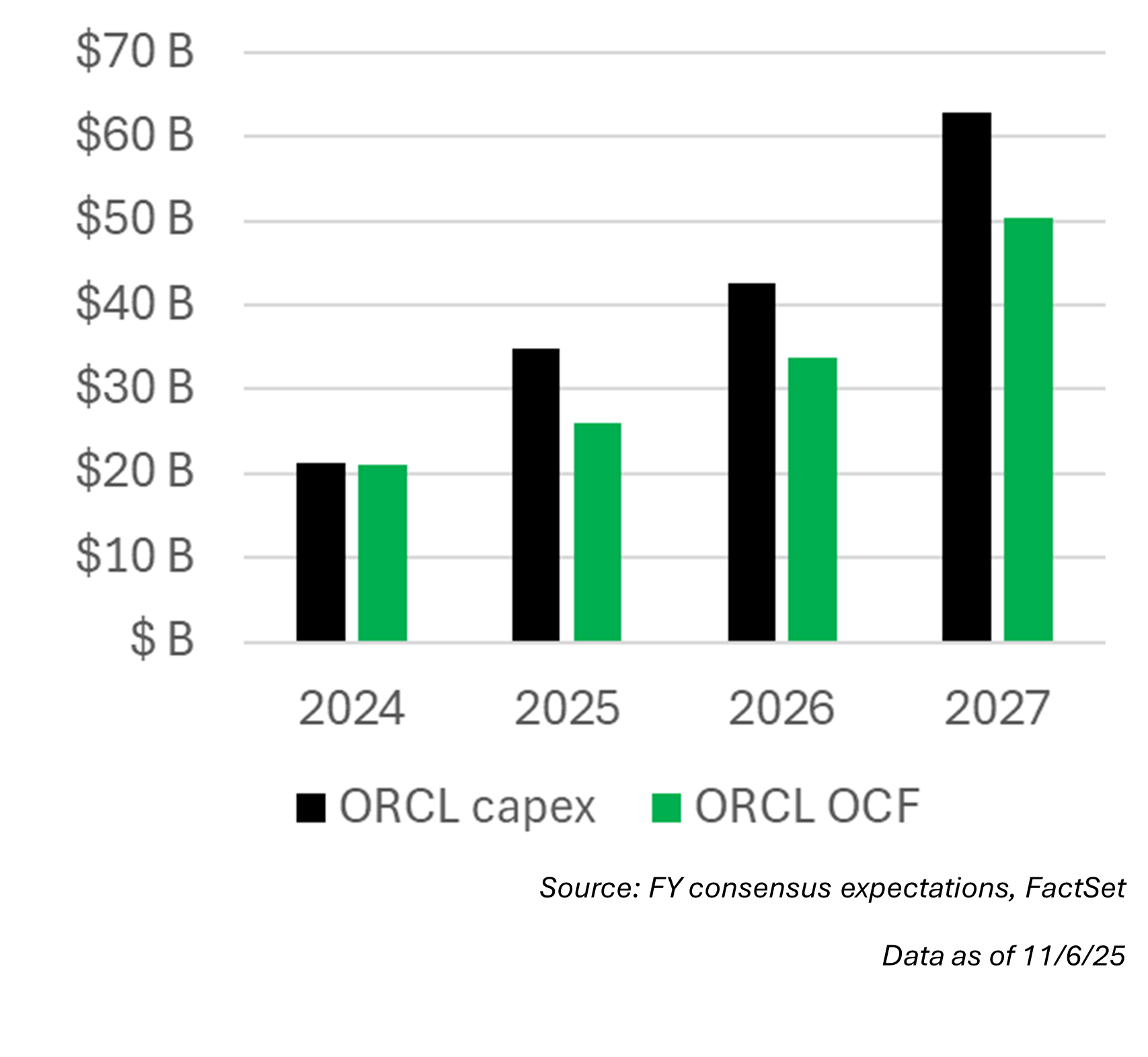

- Oracle’s (ORCL) FY2027 capex expectations have increased by a staggering 239%, from $19B to $63B, as the company reinvents itself as a provider of AI computing.

- Notably, Oracle’s (ORCL) massive spending increase is largely being driven by one significant customer (OpenAI) that has signed a long-term deal to lease computing capacity from them starting in 2027. This one deal alone is for $300B over five years.

This is all in addition to the current buildout of the Stargate Project—a large-scale initiative to provide massive AI compute capacity, including multi-GW data centers, to meet the growing demand from clients like OpenAI. Sam Altman, the CEO of OpenAI, has even outlined a vision for having 250 GW of compute capacity by 2033. Putting this number into context highlights the massive scale it would entail:- The current Stargate project is expected to cost ~$500B and have capacity of ~10 GW at full scale.

- 1 GW of power generation capacity is roughly equivalent to the needs of a city of 1M people.

- The current power generation capacity of the entire country is around 1,300 GW, which would mean OpenAI’s vision of having 250 GW of capacity equates to around 20% of the entire nation’s current power generation capacity—all in the service of one customer.

Financing and energy remain critical constraints for AI infrastructure costs and data center growth.

Rapidly evolving financial relationships among industry participants

While the expectations around future spending have gotten larger, the relationships amongst AI industry participants have also gotten more complicated. And the AI ecosystem is creating new financial structures.

- Traditional hyperscalers leasing compute capacity from neoclouds: More traditional hyperscalers, such as Microsoft (MSFT), are signing agreements with neoclouds for future computing capacity. These are essentially leasing agreements, providing computing capacity without the need for upfront capex. It should be noted that players like Microsoft (MSFT) are continuing to increase their own future capex plans while entering into these types of arrangements, with the longer-term goal being to provide themselves with much greater computing capacity. Strategically, Microsoft (MSFT) is balancing its future AI capacity by both building its own data centers—which entails big upfront capex—and leasing compute from others, which shifts that capex to partners and converts it into operating expense for Microsoft instead.

- Nontraditional financial arrangements are being announced: Industry participants are becoming increasingly intertwined financially. In some cases, this involves companies investing in, and even agreeing to buy services from, their own customers.

- Nvidia (NVDA) agrees to invest up to $100B in OpenAI, in a structure where that investment links capital to hardware deployment.

- Nvidia (NVDA) makes investments in various neocloud companies (who are their customers) while also entering into agreements to rent any unused computing capacity from them.

- Advanced Micro Devices (AMD) agrees to give OpenAI equity in their company in exchange for AI hardware purchases.

The increasing circularity of AI industry participant relationships makes the industry dynamics harder to understand and also broadens risk.

Rapid pace of change in investments highlights potential uncertainties

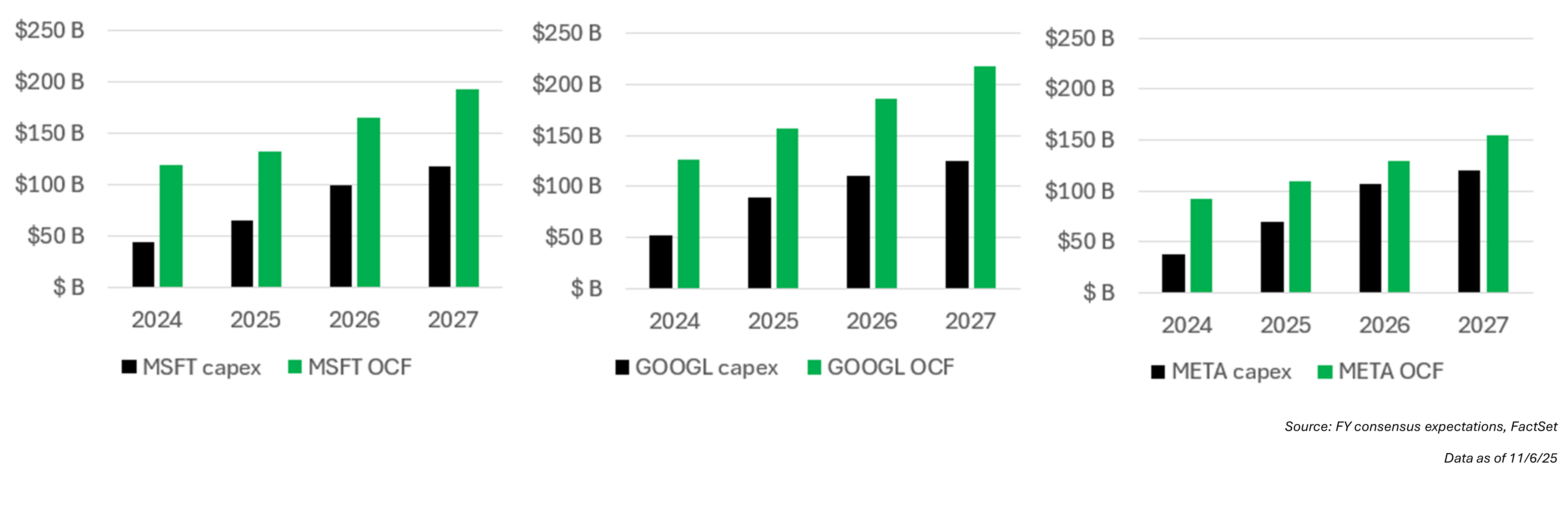

Since the beginning of 2023, our internal research teams have found that the growing demand for AI hardware has primarily come from companies with meaningful cash on their balance sheets and robust operating cash flow (OCF) profiles like Microsoft (MSFT), Google (GOOGL) and Meta (META). As these companies move to increase their AI spending even further, their strong OCF profile can continue to support.

However, over the last six months, the largest planned spending increases (measured by percentage) are coming from companies without these meaningful cash positions or robust OCF profiles. In fact, the company with the largest planned spending increases (OpenAI) has presented internal projections estimating the business will burn $115B of cash through 2029. In other words, they will spend $115B more than they take in. The question of “how will all of this be paid for?” becomes especially relevant, as the company does not have nearly the OCF profile to support the spending.

To pay for compute capacity deals already in place, such as the agreement with Oracle (ORCL), and to make their vision of 250 GW of compute by 2033 a reality, OpenAI will need to raise staggering amounts of capital.

It’s not just OpenAI that will have to turn to outside financing, though. Growing numbers of companies are becoming active in raising capital to pay for data center construction, including Oracle (ORCL), Vantage, Crusoe and xAI. Even Meta (META) has opted to pay for some of their data center construction through outside financing arrangements.

So how much will all this planned spending cost?

- Based on several industry estimates of cost/GW of compute, bringing an incremental 100 GW of AI-related compute online by the end of 2030 would cost approximately $4T. That’s trillion with a “T.”

- McKinsey recently published research estimating that to bring 124 GW of AI-related compute capacity online by 2030, the total cost would be closer to $5.2T.

- Our internal research teams believe this type of capacity is roughly consistent with the announced multiyear spending plans of industry participants, with one glaring exception: OpenAI’s ambitious target of 250 GW by 2033.

- Using the same framework as above, that amount of capacity for OpenAI alone would cost $10T.

Our internal research teams consider the incremental 100 GW situation to be the more likely outcome versus OpenAI’s more ambitious goals. Even then, $4T of capital needed to fund this expansion means that some industry participants will most certainly need to continue relying on outside financing support.

As more companies rely on outside financing, financial risk spreads across a much broader group. Paired with the increasingly circular relationships in the industry, stress in any one part of the system is now far more likely to ripple through the rest.

Power generation capacity could be a key AI constraint

Uncertainty arises when looking at whether this much power generation can come online or if there is a pending bottleneck relative to how much capacity can be added.

Data center electrical generation demand is especially elevated for natural gas turbines, which convert the energy stored in natural gas into mechanical energy.

- The turbine industry is a consolidated market where three firms have roughly 90% global market share. Their production capacity is currently constrained, but industry participants have plans to increase capacity over the coming years.

- Concerns remain that even the increased capacity will still fall short of demand. There are real world limits in both turbine manufacturer and broader electrical equipment supply chains that surging data center demand will push up against. For example, turbines are effectively sold out through 2030, and transformers have a two- to three-year backlog

Apart from generation capacity, the potential exists for other power-related constraints.

- Utility interconnections for new data centers already take roughly two years on average. Some early proposals and announced plans include large data centers procuring their own power generation, often in exchange for expedited approvals and grid interconnections.

- Power planning and development are integral to the AI data center growth the market expects. The planning and development process has historically been lengthy. Utilities and their regulators have mandates to balance many competing interests when approving new electrical generation capacity. For example, recent public pushback on large data center plans derailed two large projects: Microsoft’s (MSFT) in Wisconsin and Alphabet’s (GOOGL) in Indiana.

Power considerations remain the top concern for data center developers. They are closely monitoring supply chain constraints in both turbines and electrical equipment while working closely with utilities, regulators and grid operators to facilitate development. Our investment team is monitoring the same with an eye toward constraints that potentially hit up against either our forecasts or the market’s expectations.

It's too early to say conclusively if any of this results in an acute impact at the AI data center power consumption levels contemplated in blue chip forecasts, such as McKinsey’s earlier estimate. Though, it appears the most optimistic data center forecasts, including those of OpenAI, would encounter power constraints into the end of the decade. Long-term, increased industry capacity, reduced regulatory hurdles, grid modernization and perhaps breakthrough power generation technologies will all need to play a role in AI data center development.

The energy industry’s push to expand capacity for AI demand is another sign of how risk is spreading. Investments in turbine manufacturing and grid connections carry real financial stakes for manufacturers and utility companies, and their returns now depend increasingly on AI-driven spending and ongoing data center construction.

With AI investment risk increasing, the eventual payoff becomes essential

All of this shows how AI spending is surging—and how financial risk is spreading well beyond big tech. As both spending and risk climb, so does the level of payoff required to justify them. Put simply: AI-related revenues must rise dramatically in the coming years, or financial returns across the industry will begin to deteriorate. Costs are ramping long before revenue arrives, and gross margins are already feeling the pressure as increased spending turns into increased depreciation.

However, it is also important to highlight that there are varying degrees of potential degradation amongst industry participants. This relates to the diversity of their business models, the relative size of their spending plans and their existing financial health.

- Microsoft (MSFT) has been increasing their spending plans, but it is worth noting that they are an extremely large business with diversified revenue streams. Operating cash flow from the existing business is still covering their spending and net debt stands at only $17.6B.

- In contrast, Oracle (ORCL) is also a very large corporation, but their operating cash flow from the existing business is not enough to cover planned spending, and net debt stands at $97.7B (and growing). The future revenue tied to this AI-related spending is expected to make up a very large percentage of new revenue going forward. In Oracle’s (ORCL) specific case, this future revenue is also meaningfully tied to one customer, OpenAI.

The key takeaway is that investors need to consider AI-related spending risk at a company-specific level. The degree to which companies are exposed differs, big tech included. Understanding this is essential to evaluating fair values and risk/reward for these stocks in the current moment.

Investment, Securities and Insurance Products:

NOT

FDIC INSUREDNOT BANK

GUARANTEEDMAY

LOSE VALUENOT INSURED BY ANY

FEDERAL AGENCYNOT A

DEPOSITFor Informational/Educational Purposes Only: The opinions expressed may differ from other employees and departments of Associated Bank N.A., or any bank or affiliate. Opinions and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual. You should carefully consider your needs and objectives before making any decisions and consult the appropriate professional(s). Outlooks and past performance are not guarantees of future results. (1513)