Private Banking

Superior banking, personalized service

You’ve worked so hard to accumulate your financial assets. You deserve a wealth management strategy that works exclusively for your goals. Finding a trusted local team of financial professionals to help you manage your wealth may be one of the most important financial decisions you make.

Private Banking provides you with superior banking services, including checking accounts, customized lending solutions and access to a full-suite of financial and wealth planning solutions all built around your unique needs.

Checking, savings, and money market accounts with preferred rates

Premier credit cards and customized lending solutions

Lending solutions build around your practice

Customized executive benefits plans designed to increase retention, loyalty and performance for your top leaders.

Achieving your goals

We view each client as an individual with many interrelated—and often changing—financial needs and goals. As such, we take a hands-on approach to help you simplify your life and manage your risks so you can focus on making your life as successful as possible.

When you meet with a Private Banker at Associated Bank Private Wealth, expect them to put you first. They’ll get to know you first, and then walk with you to build your plan. If things change, we’ll monitor your progress and adjust your plan as necessary.

Our customized solutions address a range of scenarios

At Associated Bank Private Wealth, our professionals are experts in all stages and aspects of wealth. Whether you are in the first years of accumulating wealth, when hard work begins to deliver financial rewards, or you’re ready to retire, pass wealth to succeeding generations, or simply enjoy your prosperity, we have practical solutions to meet every need and opportunity.

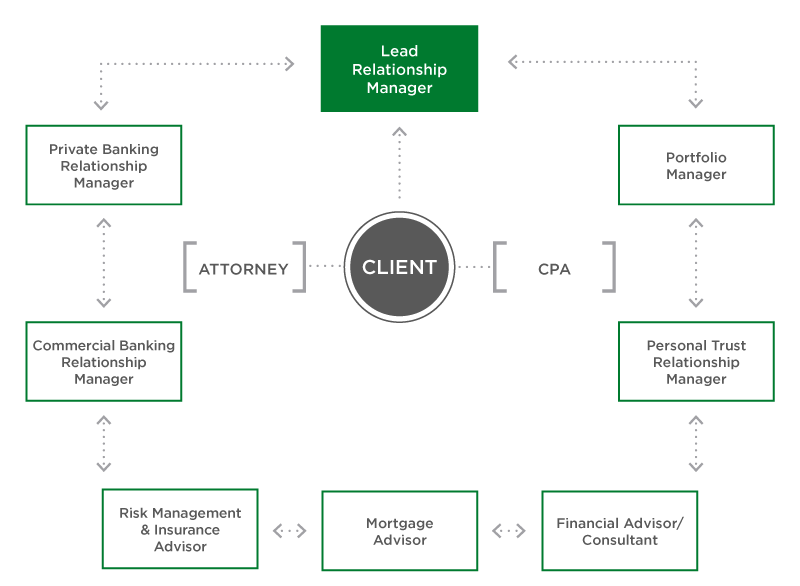

Our service structure relies on the expertise and teamwork of specialists throughout Associated Bank. Your team of financial professionals is led by your lead relationship manager — your single point of contact — who is accountable for every aspect of your financial plan and strategy.

Speak with an Associated Bank Private Wealth professional today.

Wherever you see yourself in the future, we’ll be here.

800-991-7706

Monday through Saturday

Closed Sunday and holidays

Frequently Asked Questions

Do I qualify for Private Banking at Associated Bank Private Wealth?

Private Banking services are available to clients with investable assets here totaling $500,000 or more

What should I expect at my first meeting with a Private Banker?

We will talk about a variety of topics including banking and credit management, investment, tax and retirement planning, charitable goals, and most importantly, your short and long-term financial goals. We will also ask about your family and plans for the future, discuss our service agreement, setup your accounts, summarize next steps and schedule your next meeting.

Do you offer Wealth Management services to Executives?

Yes. We can help your executive team manage two of their most valuable assets—time and money—with best-in-class solutions from Associated Bank Private Wealth. We’ve guided hundreds of executives to clarify and achieve their financial goals, applying the same acumen required to tackle complex business challenges.

Do I have access to my accounts online?*

Currently you’ll utilize a variety of digital solutions to manage your accounts and can direct you, as needed, to the right solution. Those solutions include:

- Digital Banking – view your account balances, manage your funds, and bank anytime.

- Associated Portfolio Online (APO) – view portfolio value, account groupings, holdings and more. View the full picture of your wealth through APO by utilizing their account aggregation feature.

- Associated Wealth Access – a digital tool that simplifies your complex financial picture and gives you knowledge to make sound financial decisions. View a holistic picture of your total wealth with a personal total balance sheet.

800-991-7706

Monday–Saturday

Closed Sunday and holidays

*Associated Bank does not charge a fee to download our digital applications; however, transactional fees may apply. Carrier message and data rates may apply, check your carrier’s plan for details. Visit AssociatedBank.com/disclosures for Terms and Conditions for your service. (1406)

Investment, Securities and Insurance Products:

NOT

FDIC INSUREDNOT BANK

GUARANTEEDMAY

LOSE VALUENOT INSURED BY ANY

FEDERAL AGENCYNOT A

DEPOSITAssociated Bank and Associated Bank Private Wealth are marketing names AB-C uses for products and services offered by its affiliates. Securities and investment advisory services are offered by Associated Investment Services, Inc. (AIS), member FINRA/SIPC; insurance products are offered by licensed agents of AIS; deposit and loan products and services are offered through Associated Bank, N.A. (ABNA); investment management, fiduciary, administrative and planning services are offered through Associated Trust Company, N.A. (ATC); and Kellogg Asset Management, LLC® (KAM) provides investment management services to AB-C affiliates. AIS, ABNA, ATC, and KAM are all direct or indirect, wholly-owned subsidiaries of AB-C. AB-C and its affiliates do not provide tax, legal or accounting advice. Please consult with your advisors regarding your individual situation. (1024)